Four sides attack Weichai Power actively seek opportunities for mergers and acquisitions

Lead

In the recently issued "Auto Industry Adjustment and Revitalization Plan," the state clearly stated that it is necessary to use market mechanisms and macro-control measures to promote mergers and reorganizations of enterprises, integrate key resources, increase industrial concentration, and optimize and upgrade the organizational structure of the automobile industry. The two associations also proposed this year that it is necessary to promote the reorganization of the parts and components industry, upgrade the technological level of the industry, and improve the overall competitiveness of the industry. A new wave of mergers and reorganizations will come. Weichai Power, as the largest auto parts enterprise group in China, has taken advantage of the situation, has developed momentum, merged and reorganized, and has frequently succeeded. The equipment manufacturing industry giants are ready to come.

Mergers and reorganizations have resulted in the current scale of Weichai Power

It is no exaggeration to say that it is merger and reorganization that has made Huican Power the current scale. Weichai Power is one of the first companies in the manufacturing industry to successfully use capital operations to grow and grow. In August 2005, Weichai Power (Weifang) Investment Co., Ltd. spent RMB 1.03383 billion on the strategic restructuring of the Hunan Torch listed in Shenzhen, and on November 8, 2005, successfully completed the transfer of equity ownership. April 30, 2007 The return to the A-shares was listed on the Shenzhen Stock Exchange. Marking Weichai Power's development from a single engine product business to a group company with a complete heavy-duty automotive industry chain, it has built a gold industry chain for the Chinese heavy-duty automotive industry. Weichai heavy-duty engines, Fast heavy-duty transmissions, and Hande heavy-duty axles form a complete powertrain system for Weichai Power. Shaanxi Heavy-duty Truck, as the best quality vehicle resource for the Hunan Torch, also enters heavy duty for Weichai Power. The foundation of the automobile vehicle manufacturing field has been laid.

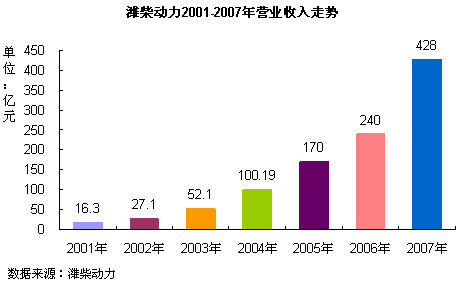

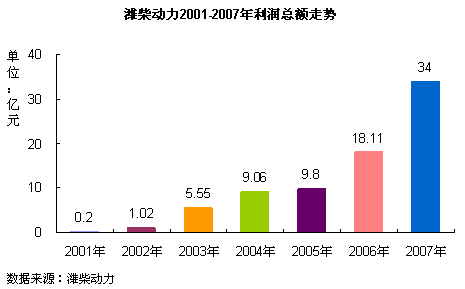

As can be seen from the above figure, Weichai's power is developing rapidly. Especially after the integration of the Hunan Torch in 2005, Weichai's power has developed even more rapidly. From 2001 to 2007, Weichai Power's operating revenue grew at an average annual rate of 75%, and total profit increased by 135% annually.

Weichai Power's 2008 annual financial announcement has not yet been announced, but Weichai Power recently evaluated the 2008 operating revenue and total profit. After preliminary calculation (unaudited), Weichai Power expects its 2008 sales revenue to be approximately RMB 33.1 billion. The operating profit was between RMB 2-4,800 million, and the total profit was between RMB 2.6 and 2 billion. In 2008, operating income fell sharply. This was mainly due to the world economic crisis that began to spread in the second half of last year and the impact of the slowdown in China’s macroeconomic growth. The national three emission standards that were implemented on July 1 last year had an advantage over Weichai’s power. The heavy truck industry also has a major impact.

Weichai Power will reorganize Shandong Automotive Industry Group and Shandong Construction Machinery Group

The "Automotive Industry Adjustment and Revitalization Plan" proposes to promote the merger and reorganization of the automotive and parts industries. Weichai Power will usher in development opportunities. Recently, it was reported that Weichai Power has obtained support from Shandong Province and is preparing to reorganize two state-owned enterprises in the Shandong Province. After the “Three Swords Togetherâ€, it is expected to sprint over 100 billion yuan worth of output. Wei Xueqin, secretary general of the Shandong Automotive Industry Association, revealed that the joint reorganization of Weichai Power, Shandong Automobile Industry Group (hereinafter referred to as “Shanhua Groupâ€) and Shandong Construction Machinery Group (hereinafter referred to as Shangong Group) has basically been confirmed and included "Shandong Province Automobile Industry Adjustment and Revitalization Plan".

Both SAAM Group and ShanGong Group are large-scale enterprise groups in the industry. The former has the capability to produce light and heavy-duty vehicles, modified vehicles, and commercial vehicles. Parts production covers several major series of heavy-duty vehicles, light-duty vehicles, passenger cars, and construction machinery, and has Jinan. Auto Parts Factory, Shandong Daewoo Auto Parts Company, Shandong Auto Gear General Factory and other wholly-owned subsidiaries and several holding companies; the latter owns Shantui Construction Machinery Co., Ltd., Shandong Linggong Construction Machinery Co., Ltd., and Taian Crane Machinery Factory. Part or all of the equity, of which Shantui shares and Shandong Lingong are listed companies.

Yantai Automobile Factory (Yaman Automobile), a subsidiary of SAIC Motors, has a heavy truck inventory. The Zhongyou Group's subsidiary Zhongyou Machinery and Shantui Group's production of excavators and bulldozers, respectively, can be effective in extending the downstream of Weichai in the industry chain. Breakthrough. If the above restructuring is completed, Weichai Power will develop from a power supplier to a complete system component supplier, and become an important production base for international heavy-duty vehicles, construction machinery and engines, further enhancing the company's international competitiveness.

Weichai Power has successfully acquired the French company Baudouin

Recently, Weichai Power, through its subsidiary Weichai Power International Development Co., Ltd., won a bid of 2.99 million euros for the assets of France’s Moteurs Baudouin (Bordouen, France), which has a book value of approximately 13.82 million euros. The transaction is now undergoing administrative approval procedures. As for the size of the company itself, the acquisition of foreign companies is an important step for Weichai Power to go abroad and contribute to the expansion of its global business and the improvement of R&D technology. This is for the internationalization of China's equipment manufacturing companies. It is also significant. From the perspective of Weichai Power's own development, we will acquire Baudouin's products, technologies and brands through the acquisition, and we can further expand our product lines, explore the international market, learn from the globalization and development of product development and technical management experience, and expand our products. The scope of market support has formed new competitive advantages and promoted the rapid development of various businesses. At the same time, it is conducive to accumulating experience in the operation of international capital and is conducive to the cultivation of international talents, which will lay a solid foundation for Weichai Power's development strategy of “internationalized new chopping woodâ€.

Weichai Power is fully purchasing French General Motors Parts Manufacturing Plant

Weichai Power disclosed on March 23 that the company is in contact with a General Motors parts company in France, but has not yet reached any intention or agreement on cooperation. Although the overall auto parts industry in China is huge, the industry is low in concentration and technology is low, and the inability to master the international advanced core component technology has always been a weakness that restricts the development of China's auto parts industry. Weichai has been impregnating the auto parts industry for decades to understand the importance of core technologies. Originally, China's auto parts companies and entire vehicles have cooperated with foreign-funded enterprises or directly purchased advanced products from foreign companies to improve their technological content. But what is paying is a high cost of technology use. Through international mergers and acquisitions, mastering leading technology and application of technology industrialization may be another shortcut to revitalize China's auto parts industry. It is for this reason that Weichai Power frequently tests water for overseas opportunities for mergers and acquisitions or cooperation.

Zhongtong bus or become the acquisition target of Weichai Power

A few days ago, the industry reported that China Heavy Duty Trucks will be reorganizing the bus, but both parties quickly denied it. In recent days, there were rumors that Weichai Power will reorganize Zhongtong Bus. Some of the luxury cars in Zhongtong Bus have already used engines produced by Weichai. On the 6th of March, Weichai Power and Zhongtong Bus stopped trading at the same time, adding a whirlwind to this issue. Weichai Power has long been a leading engine manufacturer of heavy-duty equipment manufacturing, and its industry advantages have become increasingly apparent. However, Weichai Power has no advantage in the field of passenger car engines, and has a much larger market share than Yuchai Engine. With the vigorous development of the passenger car industry, the number of passenger car sales has increased year by year. It is already Weichai Power's plan to enter the bus engine segment. A long time ago. Fast Transmission and Weichai Power have the same troubles. The Fast Transmission has absolute advantages in the field of heavy trucks, but it is far less in the passenger car transmission market. Weichai Power owns both Weichai engines and Fast transmission gearboxes, which also have strong desires to enter the passenger car field. Entering the passenger car manufacturing industry is a matter of course. Although it is still impossible for anyone to guess whether the passengers in the bus terminal are currently available, it can be seen from the disclosed information that Weichai Power's determination to take an active part in mergers and reorganizations is unquestionable. The capital operation has become the main means for the development of Weichai. one.

Conclusion

China's self-sufficiency rate for commercial vehicles is 96%, and independent brands gather. The 4 trillion financial investment will push the Chinese commercial sector to surpass the economic cycle and it is a truly "leap-forward development." Judging from the current development trend of the auto industry, the world's first-ever domestic companies in the automotive industry should be the leading market segments for commercial vehicles and parts, such as heavy trucks, gold dragons, and Weichai. Weichai Power is steadily advancing at a steady pace, and as international mergers and acquisitions are ongoing, continuous efforts are being made to achieve this goal. Weichai Power expects to expand its product line through mergers and acquisitions, control high-quality resources, learn advanced technologies, push Weichai Power to the international stage, realize the goal of “international new Weichai†and the ultimate dream of China's equipment manufacturing industry emerging from the world’s manufacturing powerhouse. .

Vertical Packing Machine Supporting Machines Co., Ltd. , http://www.chpackingma.com